Small Business Transactions Beat Pre-Pandemic Levels in Q4

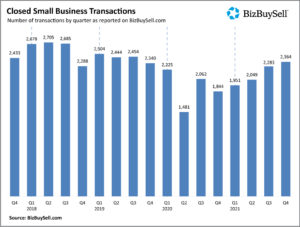

U.S. business-for-sale transactions bounced back 14% in 2021 against ongoing COVID-19 fallout, hiring challenges, and supply chain disruptions. After modest gains to start the year, transactions accelerated 28% in the fourth quarter, eclipsing the pre-pandemic levels of Q4 2019. This end of year rally brought annual small business transactions within 11% of 2019, bringing optimism for a strong 2022.

A total of 8,647 closed transactions were reported in 2021, compared to 7,612 in 2020, with 2,364 occurring in the fourth quarter. In addition, sale prices grew 16% year-over-year, as buyers competed for a limited supply of strong performing businesses. This according to BizBuySell’s Insight Report, which tracks and analyzes business-for-sale transactions and sentiment of business owners, buyers, and brokers.

Businesses that sold in 2021 continued to be those with strong financials. As the pandemic lingered, buyers gravitated to businesses with reliable sales. Savvy entrepreneurs also sought out discounted businesses that offered prime real estate and other valuable assets despite poor performance.

The business for sale market demonstrated slow, yet steady growth over the course of 2021, particularly in terms of buyer demand for financially healthy businesses. Furthermore, despite 51% of surveyed owners being negatively impacted due to COVID-19 in 2021, key financials of sold businesses in the first quarter were the highest since BizBuySell began collecting data in 2007.

According to BizBuySell’s Small Business Survey, 60% of buyers indicated profitability and strong financials as a purchase requirement, followed by trained and skilled employees (37%), great location owned (38%), and great location leased (36%). Eighteen percent (18%) desired a business discounted due to poor financials. Regarding the type of businesses buyers were seeking, the service sector was the top preference (37%), followed by restaurants (26%), and wholesale distributors (25%). The most popular included pandemic-resistant businesses such as liquor stores, gas stations, auto repair shops, and ecommerce businesses.

Buyers Face Limited Inventory as Owners Delay Exit to Focus on Recovery

While 2021 was a record-breaking year for small business sale prices, it was also a year for many owners to remain on the sidelines until financial performance improved. According to BizBuySell’s small business owner survey, roughly half (52%) of small business owners say they were negatively impacted by the pandemic in 2021, while the other half were either positively impacted (25%) or not impacted at all (24%).

Even with President Biden’s American Rescue Plan Act, which expanded the PPP program and introduced other federal aid programs, recovery has been uneven. While many businesses have wooed customers back through outdoor seating, delivery, or virtual options, they still face challenges. Whether through staffing shortages, supply chain delays, or COVID-19 surges, the pandemic continues to impact many businesses.

While restaurants, retailers, and delivery services have been among the most visibly impacted by the labor shortage, the fallout is more widespread. Whether it’s a shortage of drivers unable to move freight, or no one available to answer phones, most business are facing these challenges.

Sixty-four percent (64%) of applicable owners surveyed say they have been impacted by labor shortages, of these, 59% say the situation is not improving or getting worse. Business brokers echo this sentiment, with an overwhelming 59% saying the labor shortage is the biggest threat to small business today with Covid restrictions a distant second (15%).

Furthermore, supply chain disruptions are leaving business owners to face inventory and material shortages, sales losses, and shipping delays. Seventy-five percent (75%) of applicable owners surveyed said their business has been impacted by supply chain issues, with half of those saying the issue is either not improving or getting worse.

Small businesses have been further strained by inflation raising overhead costs, forcing many to either raise prices and pass additional costs onto their customers or cut back on operating expenses. Roughly 72% of applicable owners say their business has been impacted due to inflation, with 76% saying it has not improved or is getting worse. This can make it increasingly challenging to attract customers and remain competitive.

Pent Up Supply of Businesses for Sale Expected, Fueled by Baby Boomer Retirees

Over 78% of business brokers say they expect more sellers to enter the market in 2022, with 25% saying they expect significantly more sellers. Furthermore, brokers expect an increasing number of Baby Boomers to enter the market. Just over the past year, brokers attribute 45% of their sellers to Baby Boomers who are too burnt out to continue.

Demand for existing businesses is expected to continue into 2022 as more entrepreneurs seek to acquire profitable businesses from retiring Baby Boomers. While some will be corporate refugees and first-time buyers, many are also existing owners looking to expand, as well as retirees looking for a second career. The majority business brokers (73%) expect an increase in the number of buyers hitting the business for sale market in 2022.

Read MorePivoting: A post-COVID-19 small-business strategy

In business, just because you want something to happen, it doesn’t necessarily occur. Hope is not a strategy. There are so many environmental factors that affect our strategies. These environmental factors were fully in play during the COVID-19 pandemic. So, what is pivoting? Pivoting is shifting a business to a new strategy. It is a change in the business model, small or large, an act of moving a company from where it is now to where it wants or needs to be. Most times, pivoting references an event (e.g., the COVID-19 pandemic) that causes major disruption to your daily operations. Transformational changes have come from this pandemic.

Now that there is light at the end of the tunnel, we can more fully assess the impact of changes that were forced by the pandemic. We experienced nearly complete cessation of business life as we knew it. Loss of revenue, market shifts and demand modulation made the original concepts that formed the foundation of our enterprise no longer options to success. We had to consider: Altering the process to deliver our product or service, changing how revenue is generated, developing a new product or product line and targeting different market segments.

Pivoting means rethinking your value proposition — what are you offering? What needs, wants or desires are you fulfilling? View your target market through a new lens. Whose need, want or desire are you fulfilling? How are you going to reach them? What key activities will your enterprise be engaged in going forward. Will your resource needs change? Do your strategic partners need to be modified to meet new customer needs, wants and desires.

To do this, you need to reach out to your current customers and test how their needs will be met in the “next normal.” Will they be eating out as often as they did pre-COVID19? Will they be willing to shop in a casual manner or will their shopping be very need-specific? Will they buy lawn mowers again rather than have a landscaper visit their property? Will they return to networking groups that have a Thursday morning breakfast every week? Will they attend concerts, seminars and workshops with many other people? We have seen pivoting taking place. Gyms are offering access to exercise apps through their membership. Small craft fairs are going virtual. Furniture manufacturers are reverting to smaller wood products — baby gates, shelving, small coffee tables. The answers to all of these questions will give the owners of small businesses the rationale for pivoting.

What alternatives can a small business owner consider? Two elements need to be considered: Which of these pivots can increase the revenues generated by your business and which option carries the most reasonable risk. You do this by running a variety of cash-flow analyses based on assumptions for each pivot change. Focus on your offerings – your pivot might be based on “less is more.” Instead of adding more products or service offerings, reduce what you are offering. Narrowing your offerings to the most profitable and obtaining higher conversion rate by targeting your customers more effectively.

Modify the expense model of your business. How can you re-create the expense side you’re your business, namely, can you manage your business with less travel or less people? Did using distance communications allow personnel still working do more with less? Can you reduce the expense side of your model? This means reevaluating your resources. What does it really take to operate the business? Maybe the pivoting answer is in restructuring your business.

Evaluate customer need and find one that you are not currently meeting. Your customer base may be the same, but their needs have changed over the past two years of the pandemic. What else can you offer them to meet their needs differently? It might mean adding products or services, or making your business a one-stop, when before the pandemic, customers were willing to make multiple stops. Consider creating a sub-brand. Can you subdivide your business to offer a sub-brand targeting on a different market segment? The pivot doesn’t have to monumental. It can be a small change that allows you to operate more profitably in a changed business climate.

Evaluate your current resources. What are the skills and expertise of your staff? You may have to reduce your staff and hire those with different skills or even add staff to fulfill a pivoting strategy of new products, services or sub-branding. You also might be able to reach out to your suppliers, strategic partners and even customers to leverage their resources to support your pivot. Once you have figured out the NEW direction, then align the rest of your business plan to support that change in direction. Research is the key. Talk to your customers, hold panels of customers using Zoom to address how you will be serving their needs in the future. You need to update your business model plan since every single element in your business will be affected by your pivot. Create a new business name or brand; get new businesses licenses or EIN; acquire new space in which to operate; lay off or hire staff; train your staff to deliver your product or service differently; sell off your old products, supplies or inventory; sell your old equipment or reuse it in your new model; develop new partnerships with suppliers and manufacturers; and engage outside services such as accounting, marketing or website management.

The last suggestion in pivoting is to communicate what you are doing. Being transparent with your customers and marketing, in general, will enable you retain current customer loyalty and attract new buyers.

Read MoreWhy Market Multiples Differ For “Seemingly” Similar Companies?

Ever wondered why two seemingly similar companies sell at different multiples of SDE or EBITDA? What factors are buyers considering which results in sale price differences? Here are some company characteristics that push a market multiple higher or lower:

- Documented Revenue/Earnings Trends

Buyers are willing to pay more for companies which are able to show verifiably consistent upward revenue/earnings trends than companies with questionable financials and downward trends. Characteristics leading to a higher multiple might include:

- well-documented financial statements and tax returns are essential;

- cash, COGS and business expenses are appropriately documented;

- non-essential, non-recurring expenses are minimized;

- detailed report of business assets (tangible and intangible) and liabilities is available; and

- the business has “prequalified” lendability.

- Growth Potential

Buyers are willing to pay more for companies with high growth potential than companies perceived as having low growth potential. The reasons are high-growth-potential companies generally have the following characteristics:

• create exceptional customer value;

• exploit high-growth market segments;

• are innovative;

• have a strong brand identity;

• create product/service differentiation; and

• invest in the development and delivery of new or enhanced services.

- Low Cost and Ease of Scalability

Buyers are willing to pay more for companies that can scale up easily/quickly and at relatively low cost. Conversely, capital-intensive companies are often high-cost/difficult-to-scale businesses that require significant reinvestment to increase capacity. Ways to enhance a company’s scalability may include:

• use technology to create employee efficiencies;

• focus on reducing/eliminating redundant tasks;

• offer value-added services or develop competitive advantages that increase profits;

• standardize service offerings to reduce capacity constraints; and

• identify ways to access quality candidates for potential new hires.

- Diversified Customer Mix

Buyers value a diverse customer mix with little concentration. If a company relies heavily on a single or few customers, the company risks:

• major impact from the loss of a contract;

• lacking leverage during contract negotiations and being forced to accept a less favorable contract;

• payment delays that may significantly affect cash flow; and

• customer audits that lead to disputed claims. - Low Company-Specific Risk

Buyers are willing to pay more for low-risk companies than high-risk companies. In addition to the factors above, Low-risk companies tend to be those with:

- Longevity (5+ years in business);

- Substantial hard asset value;

- Owner retirement;

- Absentee ownership;

- Stable management team in place;

- Long-term quality employees and customers;

- Apparent competitive advantages;

- Proprietary or exclusive products;

- Up to date assets and premises in superior condition;

- Highly favorable lease terms or ownership of real property;

- Desirable location;

- A high demand enterprise (manufacturing, distribution, or business to business service);

- Favorable seller financing; and

- Easy to understand motivation for selling.

The Bigger Picture

It is quite common for buyers and company owners to perceive the market value of a specific company in terms of market multiples based on prior sales of similar companies. But, when comparing the company to “similar” companies that have sold, they may not consider information about matters such as documented revenue/earnings trends, growth potential, scalability, customer mix and company-specific risk of those prior sales. Understanding these factors is critical to arriving at the most probable purchase/selling price for a company.

Read More

Impact of Potential Tax Changes in 2021

The coronavirus pandemic resulted in changes to business taxes in 2021. Businesses saw many new tax incentives, breaks and rules as the U.S. government tried to combat COVID-19’s toll on the economy. Here are some of the new programs and changes:

- Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act introduced the Paycheck Protection Program (PPP) as an emergency loan that allocated billions of dollars to small businesses. The PPP is a forgivable loan, so long as the funds are utilized to fund payroll, rent/mortgage and utility payments. Any money a business received and was forgiven through the PPP is not considered taxable income, though any amount that is not forgiven is taxable business income.

- Economic Injury Disaster Advances and Loans (EIDL). To help businesses affected by mandatory shutdowns or economic slowdowns caused by the coronavirus pandemic, the U.S. Small Business Administration (SBA) expanded the EIDL program. A business that received advances from an EIDL is not required to include these amounts in taxable income. EIDL loans are handled like any other loan for tax purposes.

- Employee Retention Tax Credit (ERTC). Businesses affected by COVID-19 can use the ERTC to retain staff members. To qualify, a business has to have been fully or partially closed due to a government-mandated shutdown or experience a decline in gross receipts of more than 50% for any given quarter when compared with the same quarter in 2019. Employers that qualify for the ERTC are eligible for a tax credit equal to 50% of qualifying wages, up to $10,000 per employee between March 13, 2020, and Jan. 1, 2021.

- Families First Coronavirus Response Act (FFCRA). The FFCRA required certain businesses to provide sick/family leave to employees who were affected by COVID-19. Businesses that made these payments are eligible for tax credits for 100% of the cost of sick-leave pay, family-leave pay, qualified healthcare plan expenses and the employer’s share of FICA taxes for sick-leave expenses they incurred under the FFCRA.

- Business interest expense deduction increases. Finally, under the CARES Act, the allowable business interest expense deduction was increased for some business entities from 30% to 50% of adjusted taxable income.

Key takeaway: The CARES Act, EIDL, ERTC and FFCRA played key roles in helping businesses weather the coronavirus storm in 2020. It is important to know how these changes may affect your taxes in 2021.

How future tax changes may impact small businesses

Small businesses are a driving economic force in the United States, with nearly 32 million firms (including sole proprietors) employing almost half of the nation’s private workforce (Small Business Administration).

Higher tax rates may impact certain pass-through businesses

Most small businesses are S corps, LLCs, partnerships, or sole proprietorships, and are structured as pass-through entities. Net income generated from these businesses flows-through to the owner’s individual tax return. Under the current House proposal, higher-income business owners would face a top marginal tax rate of 39.6% instead of the current 37% tax rate. Under the proposal, the top rate would apply to those with more than $400,000 in taxable income ($450,000 for married couples filing a joint return). The higher rate would apply to taxable years beginning after December 31, 2021.

The 3.8% surtax to include “active” business income

For nearly a decade, higher-income taxpayers have been subject to a 3.8% surtax on net investment income including, for example, interest from investments, capital gains, dividend income, rental income, royalties, and income from a business activity where the taxpayer is not considered an “active” participant. Under the current rules, income received by an individual who is actively participating in the business as defined by the tax code is not subject to the 3.8% surtax. The new proposal would modify this to impose the surtax on net investment income derived in the ordinary course of a trade or business.* This provision would apply to those with modified adjusted gross income exceeding $400,000 ($500,000 for couples) and is effective for taxable years beginning after December 31, 2021.

* The proposal would ensure that all pass-through business income of high-income taxpayers is subject to either the net investment income tax (NIIT) or self-employment tax.

Limits on the deduction for qualified business income (QBI)

The Tax Cuts and Jobs Act (TCJA) introduced a provision in the tax code which provides a 20% deduction for certain taxpayers receiving income from pass-through businesses depending on the nature of the business and their income. The current House proposal would set additional limits on claiming that deduction by limiting the amount of the total deduction to $400,000 for an individual tax return and $500,000 for a joint return. Note there are some other proposals being discussed in Congress, including the Small Business Tax Fairness Act, that would disallow the QBI deduction for taxpayers with income exceeding $400,000.

Restrictions on certain wealth transfer strategies

Since the House proposal calls for reducing the lifetime gift and estate tax exclusion from almost $12 million per person to roughly $6 million beginning in 2022, those holding a significant portion of their net worth in closely held business interests may need to review their current estate plans. There are a number of advanced strategies available to taxpayers to transfer closely held business interests tax-efficiently with respect to estate and gifts taxes, and potentially to income taxes. For instance, applying valuation discounts when transferring shares of a closely held business to the next generation. The IRS allows a “lack of control” discount when minority interest shares of a business are transferred. The lower the business ownership shares are valued, the greater the number of shares can be transferred under the existing gift tax rules. Another strategy involves selling appreciated shares of a closely held business to an intentionally defective grantor trust in exchange for a long-term promissory note. There may be no capital gains realized on the sale of the assets to the trust, and transfer of assets to the trust removes them from the grantor’s taxable estate.

The House proposal targets both of these strategies. First, valuation discounts would no longer apply to non-business assets, defined as passive assets that are held for the production of income and not used in the active conduct of a trade or business. Passive assets may include investment securities held by the business, for example. Valuation discounts would still be available for assets that are utilized during the normal course of operating the business. Lastly, the proposal would also, for example, consider the sale of assets to a grantor trust a taxable event if the grantor is deemed an owner of the assets. The effective date for both of these proposals is after the date of enactment, which means when the bill is signed into law.

House plans underscore the need for tax planning

Odds seem increasingly likely that Congress will succeed, using the budget reconciliation process, in passing a tax bill between October 1 and the end of the year.

The House proposals, and the larger debate to follow on budget reconciliation, could result in higher taxes for businesses. There are many ways that smaller businesses could face higher tax liabilities if these measures are approved. As with all policy developments, it’s important to monitor potential changes and discuss the impact on financial plans and tax-smart planning with a professional advisor or tax expert.

Tax changes alone shouldn’t dictate your decision to sell. That said, specific proposals under President Biden’s American Families Plan are impacting exit planning. Most salient include the proposal to nearly double the top long-term capital gains tax rate to 39.6% (43.4% if you include the net investment income tax), and taxing the appreciated value of unsold assets at the owner’s death. Long-embraced strategies for tax planning efficiencies are being upended by these proposals.

Consider, for example, a business owner planning to make a bequest of family business interests to his or her children at death. The owner could see that bequest treated as if it were a sale for income tax purposes, taxable at the 43.4% capital gains rate (subject to certain exemptions and payment deferrals); in effect, the owner could see a loss of the basis step-up tax benefit for gifts from holding those assets until death. Moreover, this tax would be independent of the gift and estate tax, currently assessed at 40% on amounts gifted or transferred at death in excess of $11.7 million per person. An increased estate tax rate and a lower exemption amount under the Biden plan would exacerbate the tax hit.

Key takeaway: Often you as an owner don’t have the luxury of scripting the precise timing and path between formation and exit. If external forces (e.g., market conditions or tax law changes) are driving the sale of your business before year-end, there’s still time for effective estate planning measures.Acting now could have a meaningful impact.

Read More