Net Income Effect of Overstating & Understating

Business owners sometimes make value judgements that affect net income. Legitimately, some income statement entries are estimates. If you overstate or understate such entries as inventory, net income can be shifted up or down. That may give the owner, prospective buyers and/or the IRS a distorted idea of how your business is doing. At worst, a business owner may be accused of fraud or tax evasion.

Why Net Income Matters

Investors and lenders study financial statements to decide if a business is a good risk. The income statement, which shows how much a business earned in a given period, is particularly important to investors. Public company dividends are paid based upon net income; dividends divided by the number of shares yields earnings-per-share. Overstating net income can make earnings per share better. It may also affect performance-based bonuses. Conversely, understating net income can make a company look less profitable, and therefore less desirable. Even so, there are reasons business owners deliberately opt to understate it.

Distorting Revenue

The top of the income statement deals with revenue for the period. Income includes cash sales and credit sales, which are accounts receivable as credit sales are income a company has earned but haven’t received yet. Some of that debt may never be paid, for example when customers refuse to pay or go bankrupt. By looking at how many bills went unpaid in the past, a company can estimate how much of current debts will also go unpaid. Understating the amount of bad debt makes both the income statement and balance sheet look stronger and healthier. For every debt not written off, net income gets a little bigger. Likewise, if a company understates the amount of bad debt anticipated, that makes the revenue and net income figures higher.

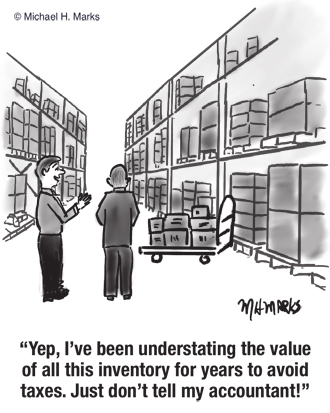

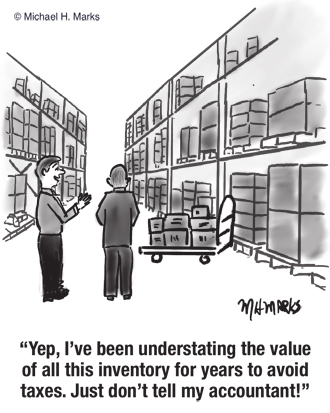

Inaccurate Inventory

Revenue minus cost of goods sold determines gross income. Various other additions and subtractions turn gross income into net income. Cost of goods sold is based on the difference between beginning and ending inventory. If a company overstates inventory, indicating they have sold fewer items, cost of goods sold shrinks and net income gets larger. If a company understates inventory, net income becomes smaller than it really is. Business owners may err in that direction to pay less in taxes in a given year. Or, inventory may be deliberately overstated to pad net income.

Problems with the Accuracy of Financial Statements

While a business owner can tout the success of a business, their financial statements are the proof that an investor or lender will ultimately rely upon. Inaccurate financials may result in:

Ruining buyer trust – If a buyer believes that an owner intentionally withheld or falsified information, the buyer may just choose to walk away from the deal, even if it truly was an honest mistake.

Delaying the process – When a buyer or a financial advisor that they have hired discovers an error, the sales process can grind to a halt. The sale of a business can be delayed for weeks or a month or more while an owner and the prospective buyer try to reconcile the error and/or dive deeper into the financials.

Loss of financing – A buyer who is relying on outside financing or investors to raise funds for a purchase might lose their opportunity to obtain funds, causing the deal to collapse.

Legal liability – In the event that the sale is completed without a material error being discovered prior to closing, a business owner could one day run the risk of a claim or litigation for fraud, even though the error may be an honest mistake.

Read More

The 12 Laws of Karma Applied to Business Ownership

You are more likely to success as a business owner if you are motivated to help solve other people’s problems, not your own. Karma describes the concept of getting back whatever you put forth, good or bad, into the universe. By definition, it’s central to Hinduism and Buddhism for determining a person’s next existence based on the ethical net of their current life. But no matter which belief system you follow (or don’t), many believe the concept of karma plays a role in our lives – and by extension, the return we will receive from our business ownership.

When you run your business in accordance with the 12 Laws of Karma, you create good karma in your business life, increasingly the likelihood for good things to happen in the future. Below, find a breakdown of what each of the laws mean, plus tips for how to harness their power for your business’ success.

1. The great law

Also known as the law of cause and effect, the great law is what comes to mind for many people when considering what karma means. It states that whatever thoughts or energy we put out, we get back—good or bad. It’s like sowing and reaping. If you truly are an ethical proprietor, the kindness, knowledge and extraordinary help you bestow on your customers will net you greater returns in terms of revenue and profits.

2. The law of creation

The law of creation is all about creating. You don’t just wait for good things to magically happen in your business; you have to actively go out there and make things happen. Highly successful businesses are prime examples of people who embody this karmic law. They are constantly searching for creative ways to identify customer needs and offer products and services to meet those customer needs.

3. The law of humility

In order to change something in your life, you first have to accept what currently exists. That is the premise of the law of humility. This is also a trait shared by many highly successful business owners. Highly successful business owners are constantly assessing their current knowledge and seeking out education, training and/or new employees that will help them to better serve their clients.

4. The law of growth

As its name suggests, the universal law of growth is about expansion, namely within ourselves. As we grow, change, and evolve internally, our external reality will change and grow as a result. This, again, is where personal development, education and training can come into play. And growth potential never ends—there are always new things to learn, and better ways to be that trusted business owner.

5. The law of responsibility

The law of responsibility is about taking ownership for everything that happens in our lives, including the not-so-good stuff. We are responsible for how we show up in the world, how we allow others to treat us, and how we treat other people. In order to put this law into action, take responsibility for the part you play in every customer interaction.

6. The law of connection

The law of connection states that everything and every person is connected in some way. For example, although the past you, the present you, and the future you may seem entirely different, they are all still you. Everything you’ve experienced has led to the next thing and the next thing and the next thing. It’s all linked. The same applies to your business. Recommendations come from past customers. Your reputation is the sum of your past actions.

7. The law of force

Although some of us may claim to be a pro at multi-tasking, the inclination to do everything at once often just slows us down. The law of force states that you cannot apply your energy toward two things simultaneously. Our days are full of distractions. Realize there are times you will need to give full attention and devotion to a customer to serve their needs.

8. The law of giving and hospitality

This law of karma is all about selflessness, giving to others, and practicing what you preach. It’s about ensuring that you’re not simply saying and thinking good thoughts, but that you also walk-the-walk and follow those beliefs with action. Some of our best referrals come from helping a customer solve a problem – even when extra time or expense was necessary.

9. The law of here and now

The law of here and now is all about being present. Many of us dwell too much on the past – to the point of distraction. If, instead, we live in the here and now and are attuned to what we are doing, seeing, and really listening, we won’t be disconnected when we are interacting with customers. You will notice that the energy is different, and the experience is more engaging and rewarding, and your mind will be more keenly focused.

10. The law of change

If you’ve found yourself experiencing the same undesirable situation over and over again, this may be due to the law of change in action. It’s the universe’s way of nudging you to learn a lesson. The pattern will continue to repeat itself until you connect your feelings and learn from the experience; and take action in order to change the pattern.

11. The law of patience and reward

This karmic law essentially translates to “hard work pays off.” It’s about showing up and doing the work and not giving up on your big goals, even when you don’t see any progress made toward them quite yet. Live in accordance with this karmic law by knowing that achieving great things requires time and persistence, not giving up, celebrating yourself, and savoring every little milestone you achieve along your journey.

12. The law of significance and inspiration

The law of significance and inspiration tells us that we all have value to give. By extension, your training, experience and commitment are gifts meant to be shared with your customers and you will make a positive impact. Many of our customers have less than full knowledge of your product/service. So, your expertise is critical to them. Tap into this karmic law whenever you need a boost of motivation.

There is nothing more rewarding than positive feedback, and in this modern age – positive reviews. The resulting karma you have created nets immediate financial reward, as well as likely referrals in the future. And, it is one more experience which you can catalog for the benefit of future customers.

Read More

Buyers: Capitalize on Unprecedented Business Acquisition Opportunities in 2021

Demand for business acquisitions is accelerating, rather than being dampened by COVID-19 for many sectors. This trajectory reflects a market driven by baby boomer demographics, low interest rates, available capital, opportunity seekers and business owners either well-positioned to profit or forced to exit. Market watchers look for both Main Street and M&A deal flow to soar in 2021.

On the supply side, all businesses have been impacted by COVID-19. Some have benefited from changes in consumer demand, while others have been challenged to modify their business model. However, the underlying demographics of business ownership have not changed. Aging baby boomers will be transferring their businesses, as time does not wait for pandemics to resolve.

On the demand side, there has been a shift from a predominant seller’s market to a buyer’s market. This usually refers to a situation in which supply exceeds demand, giving purchasers an advantage over sellers in price negotiation. But, in this case the advantage is driven by buyers feeling they can buy a business for a better value, low interest rates and unemployed workers not ready for retirement turning to business ownership to seek more control of their future.

In helping buyers/sellers through ownership transition process for over 18 years, we’ve identified some tips for buyers beginning their search.

#1: Find Opportunities Where Your Abilities, Skills and Resources Overlap Your Interests

Before you start searching for a business to buy, take the time to understand yourself, and where your abilities, skills and resources overlap with your interests. It is not productive to investigate any business that isn’t a good match. For example, consider which business categories and characteristics are not a good fit, and eliminate those businesses from your search.

Start by envisioning yourself as owner/manager of a company you might consider buying. What value do you bring to the business? Do you have sufficient resources to complete the purchase, with a cushion of additional resources for working capital and/or unexpected expenses? Would you be excited to tell your friends and family about your new venture? Being able to answer these types of questions will help narrow your search to only the businesses that would be a good fit for you.

#2: Be Prepared to Sell Yourself, Not Just to Be Sold

Once you have a complete inventory of your abilities, skills, resources and interests, you can sell yourself to business owners, which is something that so many buyers neglect. Most buyers approach the business acquisition process like angel investing. They ask, “Why should I invest in this business?” But business acquisition generally works the opposite of angel investing.

Most business sellers have tremendous pride in the business they created, and the value of their years of sweat equity, risk taking and the successful navigating of economic cycles. Instead of approaching the process with a “sell me on this opportunity, then I’ll invest my money” attitude, look at the process like you’re interviewing to be the CEO of the company.

Yes, money is a big part of getting a deal worked out. But sellers are also going to make decisions based on qualitative determinants. Is this buyer capable of continuing the legacy of my company? Can this buyer step into my shoes? Will this buyer take care of my employees and customers? So, make sure you do everything you can to instill confidence in you as the buyer and your ability to be a successful owner of the business.

#3: Consider the Big Picture First

Nine out of ten people who inquire about a business for sale opportunity never pull the trigger. Many do not consider the big picture issues first, e.g., is this business really a good fit for me? Do I bring value to this business? Does the location work or can the business be relocated? Do I have sufficient resources for the purchase, or down payment if financed, and working capital?

Upon signing an NDA, they instead dive into the financials, asking why a certain expense line changed from year-to-year. Financial details are an important determinant of price and terms to be offered, but focusing first on whether a business fits with a buyer’s hierarchy of needs will lead to a more successful outcome.

#4: Trust but Verify

Ninety-nine percent of owners selling their business do not have ill intent. They do not purposely try to hide material facts, nor are they trying to get out the door before a tidal wave crushes them. But, many buyers make these assumptions about sellers, and that distrust kills deals.

Business ownership has a life cycle. When starting-up a company, an owner might leverage all or most of their personal assets. They might forego significant income in early years to reinvest in growth. Over time, they might experience ups and downs of economic cycles. At the point that they reach a steady state, they might become complacent with the size of the business and risk adverse to reinvesting in potential growth opportunities. Age, health, divorce or just the desire to do something different may bring them to consider an exit at this time.

Most small business owners do not take the time to meticulously prepare their business for sale. They simply know that it is time retire, to enjoy the fruits of their labor and step back from the day-to-day operations. So, don’t assume ill intent by the seller if they are unable to deliver audited financials, a business plan or need time to prepare reports on customers, suppliers and competitors. Take the time to meet with owners and listen to direct answers to your questions…then verify with available data.

#5: Do Your Due Diligence, but Avoid Analysis Paralysis

Once buyers get to a letter of intent (LOI) which expresses a desire to purchase a business, some of them make one of two fatal mistakes: (1) they get lazy and don’t do a thorough job of due diligence; or (2) they become so fearful of making an error that they stall the acquisition process with overthinking and extended information requests. Due diligence should include financially, legally and operationally vetting the target company. But, there is a point at which a timely decision to proceed needs to be made.

There’s always going to be a leap of faith in a business acquisition, so it’s perfectly normal to feel some nerves. But when you do a thorough job of due diligence, you will be comfortable when it comes time to put pen to paper. Nervously excited? Sure, but not uncomfortable.

Where to Find Businesses for Sale

Be mindful of these tips and you’ll be way ahead of the curve compared to other business buyers. As you begin your search, regularly check out Touchstone Business Advisors’ website at www.touchstonebiz.com for business opportunities throughout Colorado and the region. For assistance with your business acquisition process, contact a Touchstone Business Advisors broker for expert, confidential and personalized representation.

Read More