Net Income Effect of Overstating & Understating

Business owners sometimes make value judgements that affect net income. Legitimately, some income statement entries are estimates. If you overstate or understate such entries as inventory, net income can be shifted up or down. That may give the owner, prospective buyers and/or the IRS a distorted idea of how your business is doing. At worst, a business owner may be accused of fraud or tax evasion.

Why Net Income Matters

Investors and lenders study financial statements to decide if a business is a good risk. The income statement, which shows how much a business earned in a given period, is particularly important to investors. Public company dividends are paid based upon net income; dividends divided by the number of shares yields earnings-per-share. Overstating net income can make earnings per share better. It may also affect performance-based bonuses. Conversely, understating net income can make a company look less profitable, and therefore less desirable. Even so, there are reasons business owners deliberately opt to understate it.

Distorting Revenue

The top of the income statement deals with revenue for the period. Income includes cash sales and credit sales, which are accounts receivable as credit sales are income a company has earned but haven’t received yet. Some of that debt may never be paid, for example when customers refuse to pay or go bankrupt. By looking at how many bills went unpaid in the past, a company can estimate how much of current debts will also go unpaid. Understating the amount of bad debt makes both the income statement and balance sheet look stronger and healthier. For every debt not written off, net income gets a little bigger. Likewise, if a company understates the amount of bad debt anticipated, that makes the revenue and net income figures higher.

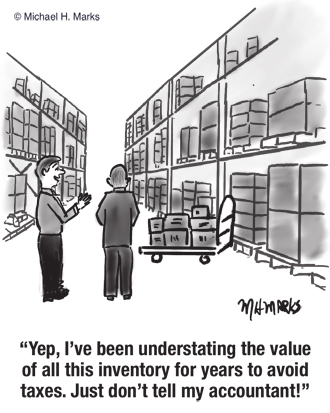

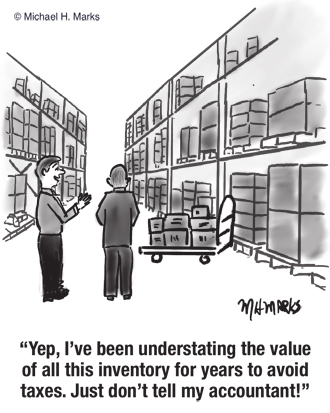

Inaccurate Inventory

Revenue minus cost of goods sold determines gross income. Various other additions and subtractions turn gross income into net income. Cost of goods sold is based on the difference between beginning and ending inventory. If a company overstates inventory, indicating they have sold fewer items, cost of goods sold shrinks and net income gets larger. If a company understates inventory, net income becomes smaller than it really is. Business owners may err in that direction to pay less in taxes in a given year. Or, inventory may be deliberately overstated to pad net income.

Problems with the Accuracy of Financial Statements

While a business owner can tout the success of a business, their financial statements are the proof that an investor or lender will ultimately rely upon. Inaccurate financials may result in:

Ruining buyer trust – If a buyer believes that an owner intentionally withheld or falsified information, the buyer may just choose to walk away from the deal, even if it truly was an honest mistake.

Delaying the process – When a buyer or a financial advisor that they have hired discovers an error, the sales process can grind to a halt. The sale of a business can be delayed for weeks or a month or more while an owner and the prospective buyer try to reconcile the error and/or dive deeper into the financials.

Loss of financing – A buyer who is relying on outside financing or investors to raise funds for a purchase might lose their opportunity to obtain funds, causing the deal to collapse.

Legal liability – In the event that the sale is completed without a material error being discovered prior to closing, a business owner could one day run the risk of a claim or litigation for fraud, even though the error may be an honest mistake.